how much taxes withheld

If you dont have sufficient tax withheld you could pay a penalty. If you have too much tax withheld from your wages you receive a refund after filing your annual income tax return.

The Irs Tax Withholding Estimator Irs Taxes Accounting And Finance Irs

Think back to when you first got your job.

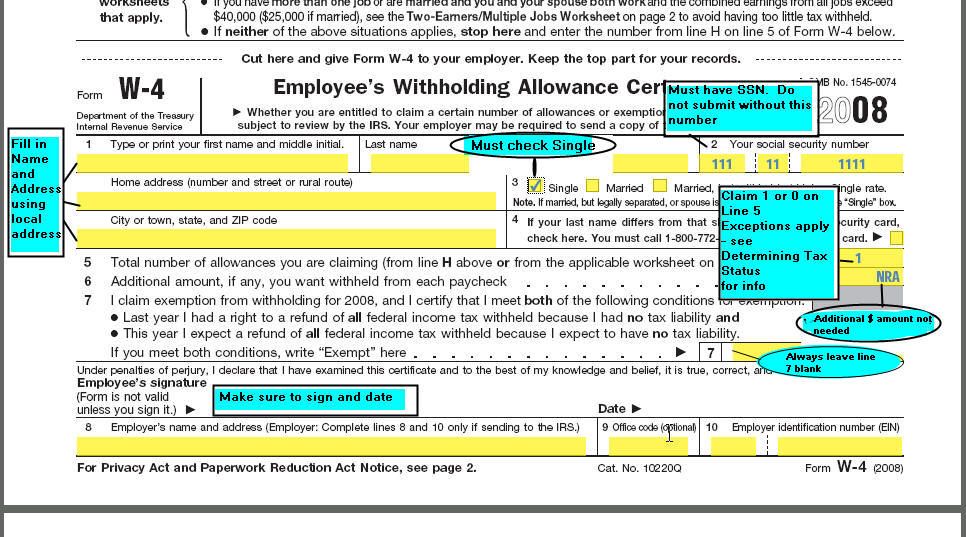

. Your employer likely had you fill out a W-4 form which helped determine how much income tax your employer pays to the IRS on your behalf each pay period. The IRS charges the penalty if your withholding amount doesnt account for 90 percent of your tax liability for the current year or 100 percent of the previous.

How To Fill Out Form W 4 In 11 Steps Tax Forms Signs Youre In Love The Motley Fool

As Another Tax Season Came To A Close It Hit Me How There S A Problematic Culture In America Regarding Tax Refund Best Tax Software Tax Refund Proposal Writer

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

Tax Filing Tips For Saving Money On Your Taxes Filing Taxes Free Tax Filing Tax Help

Posting Komentar untuk "how much taxes withheld"